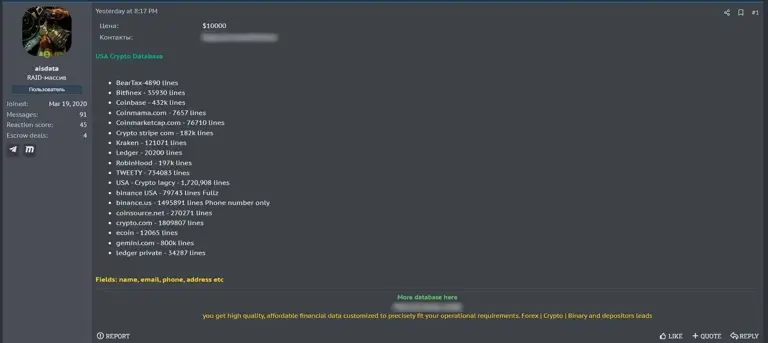

In a massive breach that could spell disaster for millions of cryptocurrency investors, an astonishing 18 million user records from some of the world’s largest crypto exchanges have surfaced for sale on the dark web. The database, advertised at a shockingly low price of $10,000, includes sensitive personal data from platforms like Binance, Coinbase, Kraken, Gemini, Crypto.com, and even retail investing giant Robinhood.

The alarming revelation first emerged through the renowned dark web watchdog, Dark Web Informer, who discovered the post on underground forums. The trove reportedly includes extensive personal information such as users’ full names, phone numbers, physical addresses, and email accounts. The sheer depth and scale of the exposed information could become a goldmine for cybercriminals, enabling them to carry out sophisticated phishing schemes, identity theft, and targeted cyberattacks.

This leak, alarming on its own, follows a disturbing trend of increased attacks targeting crypto users. Just weeks prior, a smaller but significant leak exposed over 230,000 Gemini and Binance records, signaling a troubling escalation. Despite these recurring breaches, crypto exchanges have maintained a concerning silence on the source and extent of the leaks. Official statements remain sparse, with platforms like Binance explicitly denying any breaches on their own systems.

Instead, Binance’s Chief Security Officer has pointed the finger at “InfoStealer” malware, claiming these sophisticated tools infiltrate user browser sessions, quietly stealing sensitive data without the user’s knowledge. While this explanation attempts to shift responsibility away from exchanges, users remain skeptical, frustrated at the lack of transparency and accountability from platforms entrusted with their personal and financial data.

Adding fuel to the fire, a separate seller is marketing freshly obtained crypto investor data from Robinhood accounts across the United States and Europe. Countries impacted include the UK, Germany, Spain, Switzerland, Poland, and the Netherlands, with promises of additional databases on demand. This signals an organized, ongoing operation rather than isolated incidents, hinting at potentially deeper vulnerabilities in global crypto platforms or their associated data-handling practices.

Crypto community members have swiftly reacted with outrage and calls for immediate action. Many investors and traders, already wary of centralized exchanges (CEXs), see this breach as irrefutable proof that the current model is dangerously flawed. Calls for a widespread move towards decentralized exchanges (DEXs), which promise greater user control and reduced vulnerability to mass breaches, are growing louder by the day.

This sentiment echoes recent warnings from Ethereum co-founder Vitalik Buterin, who has repeatedly emphasized the urgent need for better privacy protections in crypto ecosystems. Buterin’s advocacy for technologies like Zero-Knowledge proofs—advanced cryptographic methods ensuring transactions and identities remain confidential—feels more relevant now than ever.

As the community scrambles to mitigate the fallout, reports have emerged of phishing texts targeting Binance and Coinbase users. Hackers posing as legitimate exchange support staff are already exploiting the leaked data, further highlighting the immediate, real-world threat facing millions of users.

This incident isn’t just another headline—it’s a stark reminder of the risks inherent in the current crypto environment. While users weigh their options between centralized convenience and decentralized security, one thing is clear: this breach marks a turning point, forcing both users and exchanges alike to reevaluate their approach to digital asset security.

source: darwebinformer